Would you shop for a house or car without knowing the price? Nope, didn’t think so. You’d figure out your budget, find options that fit, and THEN decide if the price is worth it. So, why are families diving into the college search without even glancing at the cost first?

Let’s be real—college is likely the most expensive purchase you’ll ever make, aside from maybe a house. Yet too many families fall head over heels for a school before they’ve done the math. Then those acceptance letters roll in, and BAM—sticker shock. The price tag is way higher than expected, but now emotions are in the driver’s seat.

Why Ignoring the Price Is a Financial Fail

Here’s the harsh truth: picking a college without knowing what it costs is like trying to buy a car with your eyes closed.

Yes, college is expensive. But the real problem? Families choose schools they can’t afford, take on massive loans to make it work, and students end up drowning in debt after graduation. That “dream school” can quickly turn into a financial nightmare.

College Is an Investment—Get the ROI Right

College isn’t just a decision; it’s an investment in your future. But not all investments are created equal. You wouldn’t throw your life savings into a business that doesn’t have a plan to pay you back, so why approach college differently?

Before committing to a school, ask these critical questions:

- What’s the earning potential in my field?

Research the average salaries for your intended career and how long it might take to repay any loans you take out. - Does this school have a strong ROI?

Look at graduation rates, job placement stats, and starting salaries for alumni. Some schools deliver better bang for your buck than others. - Am I taking on manageable debt?

Rule of thumb: Your total loans for four years shouldn’t exceed your expected first-year salary. If it does, it’s time to rethink your plan.

Investing in college is about setting yourself up for financial freedom and career success—not sinking yourself in debt before you even start your life. A smart investment in college pays off in opportunities and a solid future, not endless bills.

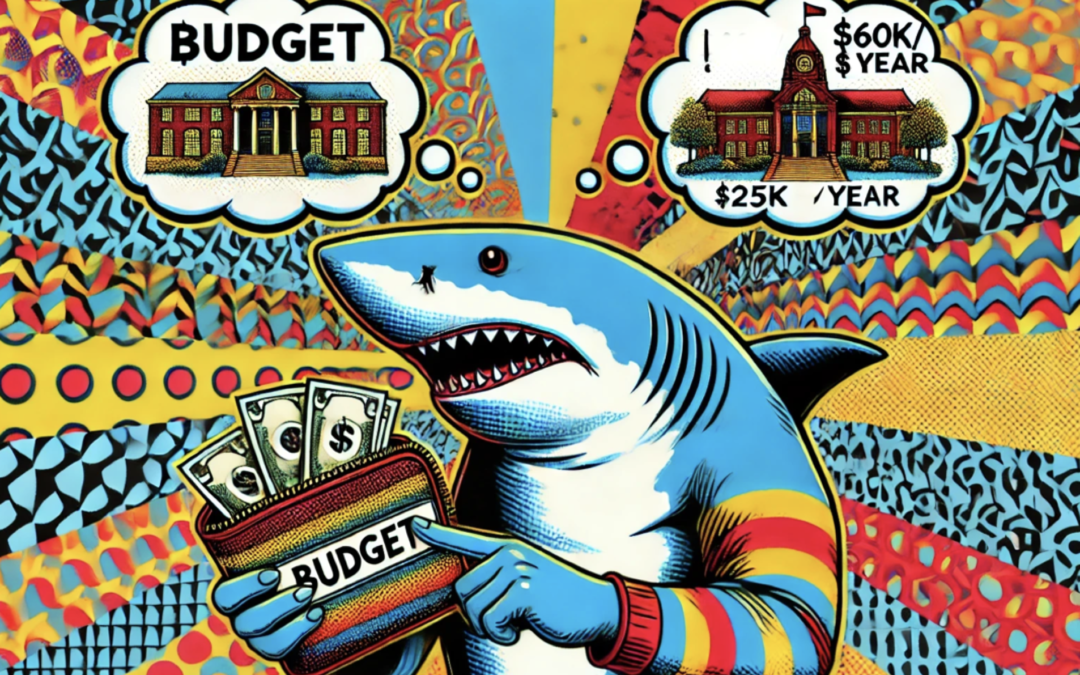

Swim Smart: Lead with the Numbers

At College Sharks, we believe your college search should start with FACTS, not feelings. So let’s get your game plan straight:

- Know Your Budget Before You Dive In

Start with what your family can afford—out-of-pocket AND in loans (if needed). Don’t forget to include housing, meal plans, books, and travel costs. - Do the Homework on True Costs

Don’t trust the sticker price! Many schools have big tuition numbers but offer financial aid or scholarships that lower the actual cost. Use net price calculators on college websites to get a real sense of what you’d pay. - Think Value Over Vanity

Forget chasing name brands. There are hundreds of amazing schools that can give you a killer education without the jaw-dropping price tag. Prestige doesn’t pay the bills. - Ask Yourself: Is It Worth It?

Remember, ROI is king. Your education should prepare you for a career that makes the cost worthwhile.

Cost Is Part of the Fit—Period

A college that’s “perfect” in every other way doesn’t fit if it doesn’t work for your budget. That’s the bottom line. Leading with cost doesn’t limit your choices—it EMPOWERS you.

At College Sharks, we help families make smarter choices. By starting with the numbers, you lower stress, protect your financial future, and keep all your options open. No gimmicks, no guessing—just clear, actionable steps to make college work for you.

It’s GO TIME! Ready to swim smarter and avoid the debt trap? Take a bite out of college admissions with College Sharks.

#CollegeSharks #CollegeAdmissions #SmartCollegeChoices #DebtFreeEducation #CollegeCosts #MeritAid #ROI #CollegePlanning #AffordingCollege #StressFreeAdmissions